Banks are now stress testing new home loan applications with mortgage rates over 7%. What does this mean for where mortgage rates are headed and what does it mean for the average Kiwi mortgage? Canstar looks at the historic trends and crunches some numbers on average mortgage repayments.

Mortgage rate stress test: What does it mean?

When you apply for a mortgage, the lender looks not only at your ability to pay the mortgage at the current mortgage interest rate, but also at projected future levels. This is to ensure that you will always be able to comfortably make the loan repayments.

Each lender uses their own stress-test levels. And unlike published mortgage rates, they don’t splash these stress-test rate levels all over their websites. However, it’s always safe to assume that a stress-test rate will be at the upper end of mortgage rate forecasts.

Recently, there have been reports of two of the biggest banks, the ASB and the ANZ, lifting their stress test levels to over 7%. This seems a huge number, given that we’ve been enjoying rates 5% and lower for the past seven years. So are rates likely to hit 7% and what would that mean for the repayments on the average NZ mortgage?

Mortgage rate stress test: Will mortgage rates really hit 7%?

Could mortgage rates hit 7% in the short term? The answer is they could, anything is possible. But ultimately, 7% is a worst case scenario.

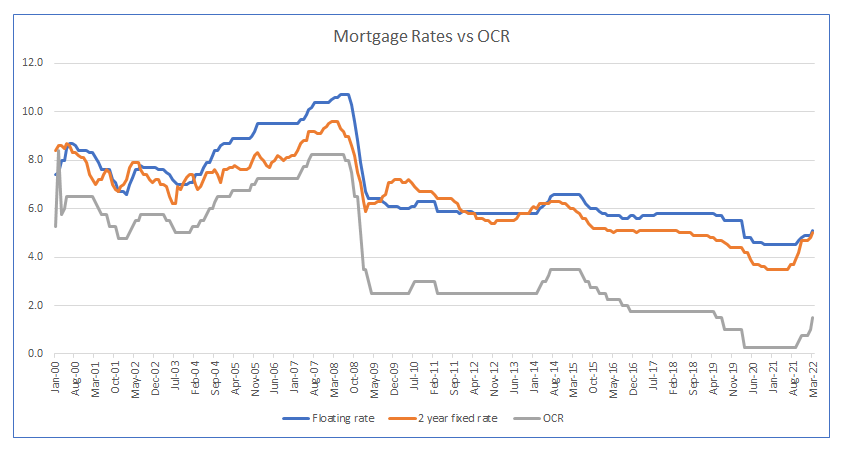

As you can see from the graph below, before the Global Financial Crisis in 2008, the average two-year fixed rate in NZ was well above 7%. And in the five years up until the pandemic, it hovered around 5%.

You can also see the correlation between the Official Cash Rate (OCR) and the rates offered by banks. Over the past two decades, the average two-year fixed rate has sat 2.5% above the OCR.

At time of writing (04/05/22), the OCR is 1.5% and the average two-year fixed rate is 5%, so it seems the banks have already passed along some of the projected increase in borrowing ahead of future OCR hikes.

However ultimately, banks are forecasting that the OCR could hit a peak of 3.25% before inflationary pressures ease. So going on the two-decade average, this would push the banks’ advertised two-year rates to 5.75%. (Although you’d probably be able to secure a lower rate if you had more than a 20% deposit and had a good credit history.)

This is still 1.25% below the banks’ new 7% stress test. But you can see why they want to add an extra buffer in there, to protect their investments and the financial wellbeing of their customers.

7% mortgage rate: Repayment reality

But if interest rates were to hit 7%, what would that mean for the average NZ mortgage?

To work out the repayments on these average mortgages, we used Canstar’s home loan repayment calculator. We based the calculations on a loan repayment on principal and interest, paid monthly over 25 years at:

- 2.86% – the average two-year fixed rate on Canstar’s database in the middle of 2021

- 4.95% – current average two-year fixed rate on our database

- 5.75% – based on current OCR predictions and historic averages, as mentioned above

- 7% – worst-case stress-test scenario

Estimated monthly repayments on an average home loan

| Lender | Average mortgage | 2.86% | 4.95% | 5.75% | 7% |

|---|---|---|---|---|---|

| All borrower types | $401,601 | $1875 | $2336 | $2526 | $2838 |

| First home buyers | $568,720 | $2656 | $3308 | $3578 | $4019 |

| Other owner-occupiers | $345,391 | $1613 | $2009 | $2173 | $2441 |

| Investors | $551,768 | $2576 | $3209 | $3471 | $3900 |

| Low-equity average mortgage | $672,102 | $3138 | $3909 | $4228 | $4750 |

It’s clear to see that even if the OCR peaks at 3.25%, and the average two-year rate moves in step to around 5.75%, people refinancing their home loans are going to be facing repayments a third higher than mid-2021. And if home loan rates hit 7%, the average monthly repayment will be 50% higher for new mortgages than those fixed a year ago.

Indeed, in its latest Financial Stability Report, the RBNZ says that “some recent mortgage borrowers could face difficulty servicing their debts as interest rates rise alongside higher living costs”.

Facing a higher mortgage rate? What you can do

While there is nothing the average home owner can do about interest rates hikes. There are steps you can take to lower your repayments. And the simplest option is to shop around.

If your fixed-rate mortgage is up for refinancing, do your homework and search out the best rate. Although the current average two-year fixed rate on our database 4.95%, there remains a wide disparity between the lowest rate on our tables, 3.75% (1-year fixed), and the highest, 6.45% (5-year fixed).

And it’s interesting to note that the minimum floating rate on our database (4.09%) now sits below many fixed-term interest rates.

Yes, swapping banks is a hassle, but it could save you thousands of dollars. And to not lose a valuable customer, a bank will often match its competitors’ rates. So for canny consumers who are prepared to do their homework and search out the lowest mortgage rates, there are savings to be made.

Compare with Canstar for the Cheapest Mortgage Rates

But while the cheapest interest rates are important. When looking for the best mortgage, you do need to look at more than just interest charges. When Canstar compares and rates mortgages and mortgage lenders, our expert researchers look at each home loan and awards points for the array of features it offers and its comparative price, which includes rates and fees.

The best products then receive our 5-Star Ratings for Outstanding Value. We place a lot of importance on our ratings, which is why the comparison grids below are sorted first by Star Rating, highest to lowest. However, if you want to compare by lowest rates instead, just click through to access our full mortgage rate comparison tables.

Best Mortgage Rates for Refinancing

The table below displays some of the 2-year fixed-rate home loans on our database (some may have links to lenders’ websites) that are available for home owners looking to refinance. This table is sorted by Star Rating (highest to lowest), followed by company name (alphabetical). Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstar’s home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Compare Cheapest Home Loan Rates

About the author of this page

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

This report was written by Canstar’s Editor, Bruce Pitchers. Bruce began his career writing about pop culture, and spent a decade in sports journalism. More recently, he’s applied his editing and writing skills to the world of finance and property. Prior to Canstar, he worked as a freelancer, including for The Australian Financial Review, the NZ Financial Markets Authority, and for real estate companies on both sides of the Tasman.

Enjoy reading this article?

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article