KEY POINTS:

- The RBNZ’s Monetary Policy Committee meets seven times annually. At these meetings, the committee sets the OCR as part of the bank’s job to keep inflation in check.

- The OCR is the rate that banks pay to borrow money from the RBNZ.

- While mortgage and deposit interest rates are influenced by many factors, they do rise and fall in step with the OCR.

What is the OCR?

The OCR is the rate that the RBNZ charges banks to borrow money from it. This cost of borrowing affects the interest rates that banks and lenders then pass on to their own customers for their loans.

Current OCR: 3.5%

At its April meeting, the RBNZ decided to cut the OCR to 3.5%. The bank also noted that further cuts could be appropriate, due to global economic concerns and the fact that inflation, at 2.2%, is still in the middle of its target band of between between 1% and 3%.

Since last August, the RBNZ has cut the OCR five times, from a decade-high of 5.5%.

What is the RBNZ and what does it do?

The RBNZ is our central bank. Its role is to set monetary policy and maintain the strength of the nation’s financial system. This involves regulating other financial institutions and keeping inflation in check by ensuring price stability.

One of the key roles of the RBNZ is to set the OCR, via its Monetary Policy Committee (MPC). At its regular meetings, the MPC discusses monetary policy, including the OCR, and can do one of three things:

- Lower the OCR, with a view to stimulating borrowing and spending in the economy

- Increase the OCR, to try to rein in spending and borrowing to keep inflation in check

- Leave the OCR unchanged – steady as she goes!

How often does the RBNZ change the cash rate?

The MPC meets seven times a year, and has the ability to change the OCR at each of its meetings. However, it doesn’t always act to move the OCR.

During times of economic stability the OCR has remained unchanged for months. For example, between November 2016 and March 2019, it sat at 1.75%.

However, if needed, the OCR can be raised precipitously. This happened in the 12 months between November 2021-22, when the RBNZ lifted the OCR from 0.75% to 4.25% to reign in the inflation caused by the RBNZ’s pandemic monetary stimulus.

What’s the OCR’s history?

In the years leading up to the 2008, the average OCR rate was around 6.5%. Then, when the global financial crisis hit, it was slashed to 2.5%, where it sat for eight years before, over three years from 2016-2019, it was cut further to just 1%. The pandemic then saw it fall to a historic low of 0.25%.

But, as we mention above, that low only lasted for a year and a half. And from November 2022 to the start of this year, the average OCR sat, stubbornly, over 5%.

You can find the full history of the OCR here.

Why does the RBNZ change the OCR?

The OCR is the main monetary policy tool the RBNZ uses to influence the NZ economy, which it uses to:

Keep inflation in check

The RBNZ states that it uses the OCR to “achieve the Government’s target of keeping inflation between 1% and 3% on average over the medium term, with a focus on keeping future average inflation near the 2% target midpoint”.

Boost or cool the economy

By loosening or tightening the cost of borrowing money using the OCR, the RBNZ can either:

- Help stimulate the economy, by lowering the cost of borrowing money, thus increasing lending and spending

- Cool the economy by increasing the cost of borrowing, helping push down prices and curtailing spending

How does the ORC affect banks’ interest rates?

While the OCR is important, and does influence how banks and lenders set their interest rates, it’s not the only factor affecting consumer interest rates.

There are three main factors that determine how banks and lenders set their interest rates:

The banks’ funding costs

Banks borrow much of the money they lend to their customers. The money comes from overseas, from NZ savers and the domestic wholesale market. The bank, in turn, has to pay to borrow these funds, in the form of interest and other charges. If these funding costs increase, independent of any OCR announcement, banks will increase their rates to protect their margins.

Competition from other banks

Banks and lenders exist in a competitive marketplace and have to compete for business. This competition can influence the movement of interest rates. Many banks offer cut-price special rates to borrowers, and bonus interest rates on savings accounts, to attract new customers.

Default risks

Banks and lenders are concerned with risk. Before lending money, a financial institution will assess a borrower’s risk of defaulting on the loan. Usually, the higher the risk, the higher the interest rate the borrower will be charged. For example, somebody with a poor credit score is likely to be charged a higher interest rate than somebody with a great credit score. Likewise, leveraged property investors will likely pay more for a mortgage than an owner-occupier with a substantial deposit.

How does the OCR affect home loans?

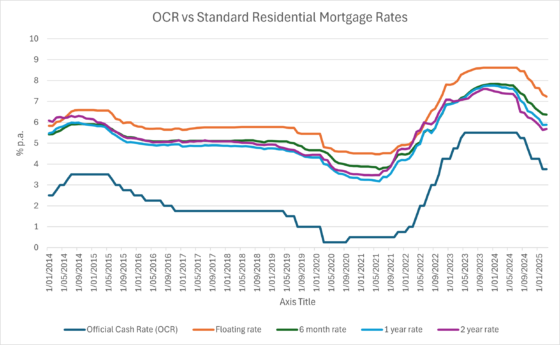

Mortgage rates tend to move in step with the OCR, as you can see from the graph below.

In the five years in the lead-up to the pandemic, mortgage rates were pretty stable, as was the OCR, which sat around 2%. During the same period, one-year mortgage rates were around 5% and two-year terms around 5.3%.

Since the pandemic, the split between the OCR and the 1- and 2-year mortgage rates has narrowed to around 200 basis points.

However, it’s worth noting that the most important thing when it comes to fixed home loan rates is what the markets predict will happen to the OCR.

If lenders think that the RBNZ is likely to shift the OCR down the track, they will reposition their fixed-rate home loans accordingly. Meanwhile floating rates tend to rise and fall almost in sync with the OCR.

How does the OCR affect deposits?

Generally speaking, interest rates on savings accounts and term deposits will also track the rise and fall of the OCR.

In mid-2021, when the OCR was 0.25%, on Canstar’s database, the average interest rate offered on a bonus-interest savings account was 0.29% and the average one-year term deposit was paying just 1.23%.

Now the OCR is 3.5%, the average rate on a high-interest savings account is 4.41% and the average one-year term deposit is 4.31%.

About the author of this page

Bruce Pitchers is Canstar NZ’s Content Manager. An experienced finance reporter, he has three decades’ experience as a journalist and has worked for major media companies in Australia, the UK and NZ, including ACP, Are Media, Bauer Media Group, Fairfax, Pacific Magazines, News Corp and TVNZ. As a freelancer, he has worked for The Australian Financial Review, the NZ Financial Markets Authority and major banks and investment companies on both sides of the Tasman.

In his role at Canstar, he has been a regular commentator in the NZ media, including on the Driven, Stuff and One Roof websites, the NZ Herald, Radio NZ, and Newstalk ZB.

Away from Canstar, Bruce creates puzzles for magazines and newspapers, including Woman’s Day and New Idea. He is also the co-author of the murder-mystery book 5 Minute Murder.

Share this article