How much can I borrow for a home?

It’s smart to have a rough idea of how much you may be able to borrow before applying for a home loan. Lenders each have their own formula for calculating your borrowing capacity or borrowing power. Broadly speaking, though, they all take into account these key factors:

- Your income. As well as your wage/salary, a lender will look at investment returns such as dividends or rent, as well as government benefits.

- Your existing debts. This doesn’t just include car or personal loans. If you have a credit card, the lender will consider the credit limit, not the balance you owe, as you could potentially max out the card after being approved for a loan.

- Household living expenses. This can take into account regular costs such as groceries and fuel as well as childcare or school fees if you have kids.

- Number of dependents. This isn’t just about children. A non-working spouse or partner may also be considered a dependent.

You can use Canstar’s Finance Calculators to get an idea of how much you may be able to borrow but keep in mind that these are just a guide and not a definite figure.

→Related article: NZ Personal Loan: How Much Deposit Do You Need To Buy A House?

What is inflation?

Rising prices have been making headlines this year, so it’s perhaps no surprise many Kiwis want to get a better understanding of inflation. In simple terms, inflation refers to rising prices. Here in New Zealand, it is measured by the Consumer Price Index (CPI), which is compiled by Stats NZ.

The CPI shows changes in the cost of a representative sample of items that make up typical household spending, such as food, housing, transport, clothing and so on. It is currently published quarterly.

The reason inflation rates have been in the news so often is that we have seen large increases in the CPI. In the June quarter, annual inflation rate was 7.3%. But since then it has receded to 5.6%. While inflation rates are slowly decreasing, they’re above what the Reserve Bank considers the sweet spot for the New Zealand economy. A modest level of inflation is generally a sign of a healthy, growing economy. That’s why the Reserve Bank sees 2%-3% inflation as the sweet spot.

Why does high inflation matter? Well, for starters, it reduces consumers’ purchasing power. This can have a flow-on effect on the economy. If consumers spend less, businesses start to produce less, and this can lead to job losses and, potentially, a recession.

→Related article: Core Inflation vs Headline Inflation

How much tax do I pay?

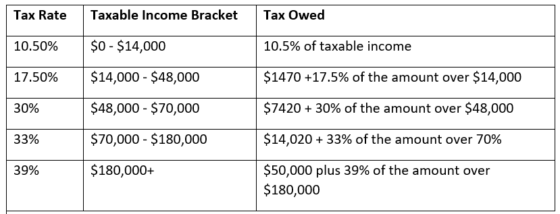

In New Zealand we have a progressive income tax system, meaning the more you earn, the more tax you pay. Taxable income is divided into different brackets – each with a progressively higher tax rate, as shown in the table below.

If you have more than one source of income, you pay something called secondary tax. This means you’ll pay the right amount of tax so you don’t get a bill at the end of the year. The amount of secondary tax you pay depends on the secondary tax code you give your employer or payer. You can find out your tax code here.

→Related article: What is PAYE Tax?

What time is Powerball drawn?

It seems like there might be a fair few Kiwis out there hoping for a lottery win. Powerball is drawn on Wednesdays at 8:20pm and Saturdays at 8:00pm.

If you’re not familiar with how Powerball works, six numbers (from 1-40), followed by a Bonus Ball are drawn. You then need to add a Powerball number from a separate set of 1-10 for each line of Lotto numbers you’re playing. Sounds easy right? Not really. The odds of winning the top prize – which means getting all six numbers plus the Powerball number in a single game – are a staggering one in 38.3 million.

How much super should I have?

Given the odds of winning Powerball are one in 38.3 million, most of us will have to fund our own retirement which is why this question is so important.

Compare KiwiSaver funds with Canstar

To work out how much super you should have now, it’s important to know how much money you’ll need to retire in the future. According to a recent study by Massey University, a single person needs an annual income of $42,970 to live a “no-frills” lifestyle in an urban area. This figure is $51,065 for a couple.

In order to achieve this level of annual income, Massey says a single person needs to accumulate $188,926 by the age of 65 for a 10 year retirement. Because men have an average life expectancy of 80 years, and females 83.5, it’s likely most need enough super to cover a 20 year retirement. A 20 year retirement for an individual living a no-frills lifestyle in an urban area requires a super balance of $377,853.

→Related article: How Much KiwiSaver do You Need for Retirement?

How do you buy bitcoin?

Bitcoin has had a bumpy ride in recent years, although has picked up in value over recent weeks. If the extreme volatility hasn’t scared you off and you’re thinking about jumping in here’s a look at how you can do it. Getting started in bitcoin typically involves a four-step process:

- Choose a cryptocurrency trading platform – look for a reputable platform and compare fees.

- Open an account – you’ll likely need to provide personal ID including a photo of yourself.

- Deposit cash into your account – this can usually be done through an online transfer from your bank account or by using a debit card or via PayPal. It may also be possible to make a deposit with a credit card but this can mean paying higher platform fees and cash advance interest rates on the card. You won’t need much cash to get started, in some cases, less than $50 will open an account.

- Start trading – head to the buy/sell section of the platform to begin trading the crypto of your choice.

→Related article: How to Buy Bitcoin in NZ

About the reviewer of this page

This report was reviewed by Canstar Content Producer, Caitlin Bingham. Caitlin is an experienced writer whose passion for creativity led her to study communication and journalism. She began her career freelancing as a content writer, before joining the Canstar team.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article