As inflation eases – it’s now back on target, sitting at 2.2% – term deposit rates are falling, but they remain an attractive investment option. Especially when you consider that the highest one-year rate in Canstar’s Term Deposit Comparison Tool is 5.7%. Our comparison tool evaluates over 470 term deposit rates from 15 providers, and is a great place to research the best rates in the market.

And now is a good time to secure a great return. For if the Reserve Bank continues to cut the Official Cash Rate, term deposit interest rates are sure to follow.

It’s also worth noting that the RBNZ’s Depositor Compensation Scheme (DCS) comes into effect from July 1. The DCS provides insurance for deposits up to $100,000 per deposit taker, when the money is held in accounts that are covered by the DCS legislation. This means that there will be less risk involved with chasing higher term-deposit returns with non-bank deposit takers.

For a quick overview, we’ve put together three easy-to-scan tables featuring the highest rates (as of 14/04/2025) on our database for:

Note: interest payment frequencies vary. Check Canstar’s comparison tables for full details.

Term deposit best rates: 6-month term

The results based on an investment of $25,000 for 12 months.

| Provider | 6-month rate |

|---|---|

| 6.00% | |

|

5.25% |

|

4.45% |

|

4.35% |

|

4.30% |

|

4.30% |

|

4.30% |

|

4.20% |

|

4.20% |

|

4.20% |

| 4.15% | |

|

4.15% |

|

4.00% |

Term deposit best rates: 12-month term

The results based on an investment of $25,000 for 12 months.

| Provider | 12-month rate |

|---|---|

| 5.70% | |

|

5.50% |

|

4.30% |

| 4.20% | |

|

4.20% |

|

4.20% |

|

4.20% |

|

4.20% |

|

4.20% |

|

4.10% |

|

4.10% |

|

4.10% |

|

3.85% |

Term deposit best rates: 24-month term

The results based on an investment of $25,000 for 12 months.

| Provider | 24-month rate |

|---|---|

| 5.50% | |

|

5.00% |

|

4.30% |

| 4.25% | |

|

4.25% |

|

4.20% |

|

4.15% |

|

4.10% |

|

4.10% |

|

4.10% |

|

4.10% |

|

4.10% |

|

4.05% |

To view a wider range of term deposit accounts, use Canstar’s Term Deposit Comparison Tool.

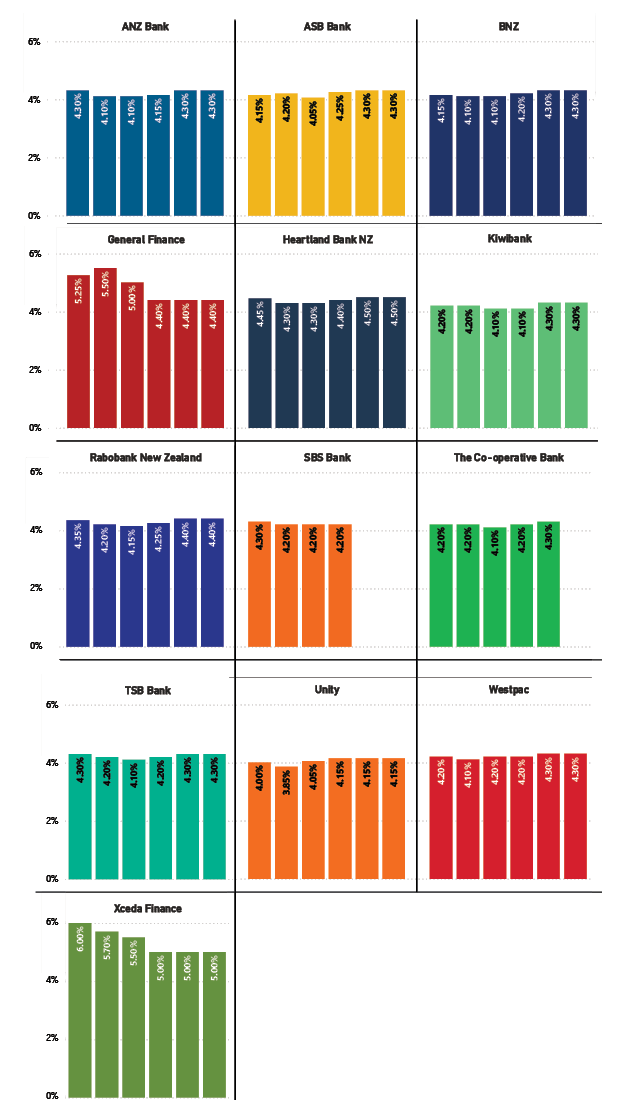

Deposit Rates

(Rates as of 11/04/2025)

Term deposits: things to consider

While a high interest rate is important, it isn’t the only factor to consider when looking for a term deposit. Some other factors you might want to keep in mind include:

Fixed time period

Choose your time wisely, because term deposits can be inflexible. For example, if you need to access your money before the end of the term, your bank may charge you a penalty fee and ask you to give them a period of notice.

Interest rates

They tend to vary a lot, depending on the provider and the term. As movements in both directions are possible, it pays to shop around.

Compound interest

Interest can be compounded at different frequencies, such as monthly, semi-annually and annually. The compounding frequency, the number of compounding periods and the interest rate will determine the amount of interest earned on a term deposit investment.

Often, you’ll receive less interest on accounts that pay interest more regularly, for example monthly, due to the added benefits of compound interest.

Deposit size

Check whether there is any minimum amount needed to open a term deposit, and if a higher interest rate is offered for a larger amounts. It may be worthwhile depositing more than you originally considered to achieve a better rate.

Fees and charges

Are there any penalties or fees charged for early withdrawals?

Rolling over

As rates are constantly moving, it’s important to be aware that if you roll over your account, you might be fixing at a lower (or higher) amount. Also be aware that sometime you can earn bonus interest if you agree to roll over your term deposit. So check with your provider to see what options you have, and what terms and conditions apply.

For the full rundown of all the up-to-date term deposit rates on Canstar’s database, just click on the button below.

About the author of this page

Bruce Pitchers is Canstar NZ’s Content Manager. An experienced finance reporter, he has three decades’ experience as a journalist and has worked for major media companies in Australia, the UK and NZ, including ACP, Are Media, Bauer Media Group, Fairfax, Pacific Magazines, News Corp and TVNZ. As a freelancer, he has worked for The Australian Financial Review, the NZ Financial Markets Authority and major banks and investment companies on both sides of the Tasman.

In his role at Canstar, he has been a regular commentator in the NZ media, including on the Driven, Stuff and One Roof websites, the NZ Herald, Radio NZ, and Newstalk ZB.

Away from Canstar, Bruce creates puzzles for magazines and newspapers, including Woman’s Day and New Idea. He is also the co-author of the murder-mystery book 5 Minute Murder.

Share this article